Hard Money Lenders in Atlanta: Unlock Fast Financing for Real Estate Projects

Wiki Article

Exactly How Hard Cash Lenders Can Assist You Safeguard Quick Financing

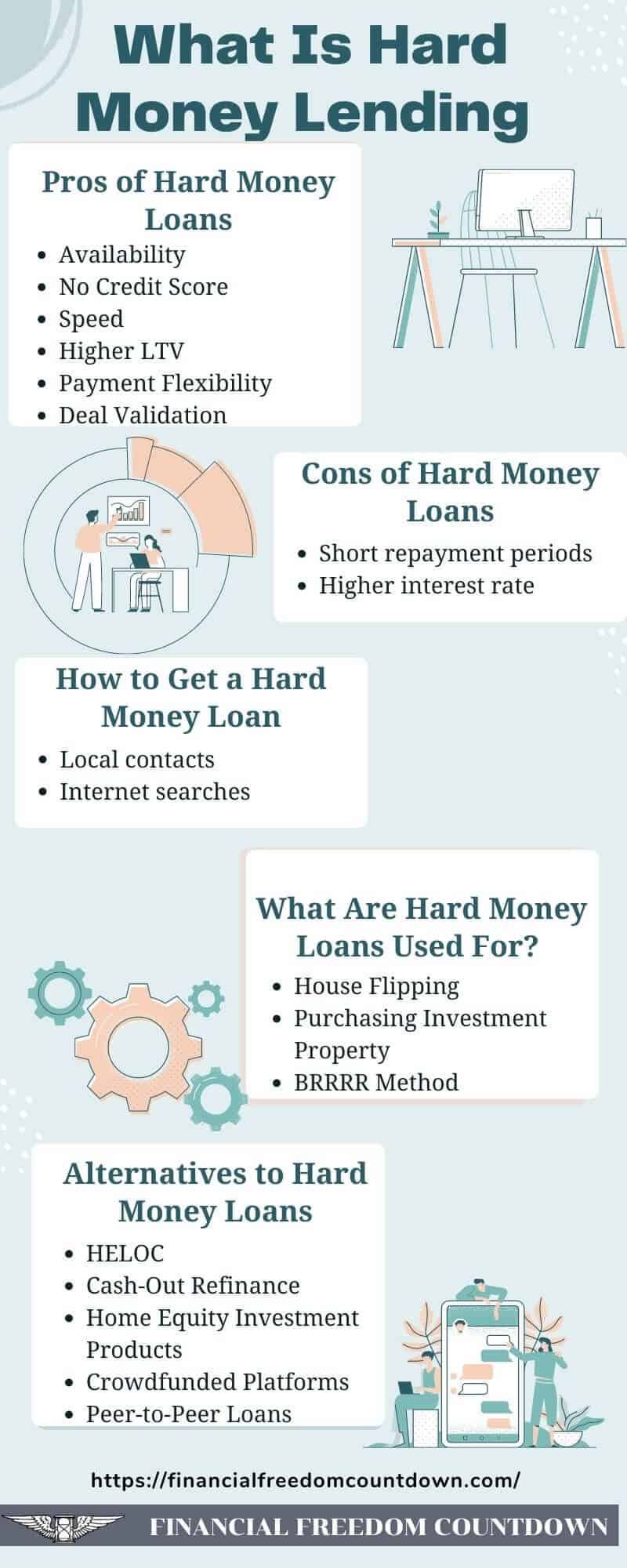

In the world of actual estate financing, tough money loan providers provide a practical remedy for those looking for quick accessibility to capital. Understanding the nuances of hard money lending and the ramifications for your financial investment strategy is important.Recognizing Hard Money Lending

Understanding hard cash offering entails identifying an unique funding alternative that largely counts on the worth of genuine estate rather than the creditworthiness of the borrower. This form of loaning is commonly given by exclusive capitalists or firms and is usually made use of in scenarios where standard funding may not be possible or prompt.Difficult money lendings are safeguarded by the residential or commercial property in question, making them an eye-catching option for investors looking for fast cash money to take advantage of chances such as fix-and-flip tasks, business genuine estate acquisitions, or immediate refinancing demands. The process is structured compared to standard finances, commonly involving much less documentation and quicker authorization times.

Consumers can expect higher rate of interest rates and much shorter payment terms, showing the enhanced threat that loan providers think because of the lack of considerable credit history evaluations. The loan-to-value (LTV) proportion is a vital variable, as loan providers commonly fund a percent of the residential property's appraised value.

Thus, understanding the nuances of tough money financing is crucial for prospective debtors, specifically those looking to take advantage of their real estate possessions for quick funding solutions. This technique offers unique chances and obstacles that require cautious factor to consider and evaluation.

Key Benefits of Difficult Cash Fundings

While traditional funding methods can typically be slow-moving and difficult, hard money fundings supply distinctive advantages that make them an appealing option for real estate investors. One of the primary benefits is the rate of funding; tough cash lending institutions can typically offer funding within an issue of days, allowing investors to seize chances rapidly. hard money lenders atlanta. This fast access to capital is essential in competitive real estate markets where timing can significantly impact financial investment successAn additional benefit of difficult money lendings is the flexibility in terms. Unlike conventional funding, which usually features stringent policies and lengthy authorization processes, hard cash lending institutions concentrate mainly on the value of the residential property as opposed to the customer's credit report. This enables even more customized lending frameworks that can satisfy specific task requirements.

Additionally, tough money lendings can be leveraged for numerous functions, consisting of building acquisition, improvements, or refinancing existing financial debt. Financiers can utilize these finances for short-term jobs, enhancing money flow and general financial investment returns. Eventually, tough money finances offer a sensible option for those calling for quick, adaptable funding, making it possible for actual estate financiers to exploit on rewarding possibilities without unnecessary delays.

Exactly How to Get Hard Money Financing

Getting hard money financing entails a straightforward process that mostly concentrates on the residential property being funded rather than you can look here the debtor's credit reliability - hard money lenders atlanta. Lenders assess the value of the residential property as the major criterion, guaranteeing that it can offer as ample security for the car loanTo start, potential customers require to give thorough information regarding the residential or commercial property, including its area, problem, and potential for gratitude. A specialist appraisal may be required to develop the current market price, which dramatically influences the finance quantity readily available.

Another important variable is the loan-to-value (LTV) ratio, which generally ranges from 60% to 80% for difficult money financings. A lower LTV shows less threat for the lender. Ultimately, customers have to also describe their exit approach, describing how they prepare to settle the finance-- whether through building sale, refinancing, or rental income. This comprehensive method makes sure both events are aligned on results and assumptions.

Regular Makes Use Of for Hard Cash Loans

Difficult money fundings are typically tapped for a variety of realty purchases that need quick access to resources. One usual usage is for fix-and-flip tasks, where investors acquire distressed buildings, remodel them, and offer them for an earnings. These finances supply the required funds to get the building and cover improvement expenses without the extensive authorization process regular of standard financing.

Another regular use is for residential or commercial property purchase throughout auctions or repossession sales. Financiers commonly need to act promptly to secure a bargain, and tough money loans facilitate prompt funding. In addition, these fundings can be beneficial for actual estate investors aiming to profit from special opportunities, such as buying land for growth or funding commercial genuine estate endeavors.

Hard cash lendings are additionally made use of by borrowers with less-than-perfect credit report or those who may not fulfill standard lending requirements. In these cases, the value of the residential or commercial property works as the key basis for the car loan, allowing individuals to access capital they could otherwise be denied. Eventually, tough cash financings function as a flexible monetary tool for numerous property techniques, enabling speedy deals and investment chances.

Discovering the Right Hard Money Loan Provider

When looking for the best tough cash lending institution, investors need to take into consideration numerous vital factors to ensure they protect financing that meets their specific needs. Examine the loan provider's experience and track record within the market. A well-known loan provider with positive reviews and a track document can use higher dependability and insight right into market patterns.Next, review the loan provider's conditions and terms, consisting of rates of interest, costs, and loan-to-value (LTV) ratios. Understanding these parameters will certainly assist determine the overall expense of Click Here borrowing and make certain positioning with your investment approach. Furthermore, inquire regarding the lender's financing speed, as some lending institutions can close bargains faster than others, which is crucial for time-sensitive chances.

A receptive lending institution that is prepared to respond to concerns and give guidance can substantially boost the loaning experience. By taking these variables into account, financiers can properly recognize a difficult money lender that not only meets their economic needs however likewise supports their general investment goals.

Conclusion

In conclusion, tough money lending institutions click to investigate provide a viable remedy for individuals looking for fast funding in genuine estate ventures. The versatility of terms and decreased credentials obstacles further boost the charm of hard cash lendings.While standard financing techniques can frequently be slow-moving and cumbersome, difficult cash fundings offer unique advantages that make them an appealing alternative for real estate financiers. Inevitably, hard cash loans supply a sensible service for those calling for quickly, flexible funding, enabling genuine estate capitalists to take advantage of on profitable opportunities without unnecessary hold-ups.

Report this wiki page